DeFi vs CeFi Compare in Crypto

The emergence of blockchain technology has transformed the financial industry, bringing new opportunities and alternatives to traditional financial services. Decentralized finance (DeFi) and centralized finance (CeFi) are two terms that have been discussed a lot in recent years. Although both relate to financial services, they are significantly different. In this article, we will explore the differences between DeFi and CeFi.

What is centralized financing (CeFi)?

CeFi refers to centralized financial services managed through centralized systems where one entity, such as a bank or financial institution, manages user funds. Centralized financial organizations provide various financial services such as banking, lending, trading and investment. Some of the features of CeFi include:

A centralized exchange (CEX)

In the CeFi world, centralized exchanges are used to trade digital assets. These exchanges are owned and operated by centralized entities such as banks or financial institutions.

To know how CEX differs from DEX, visit this page.

Fiat conversion flexibility

One of the features of CeFi services is the flexibility of fiat conversion. Users can effortlessly convert fiat currency to digital assets and vice versa, which is not so easy in DeFi protocol. With this feature, users can freely manage their funds in the real world.

What is decentralized finance? (DeFi)

DeFi refers to a groundbreaking financial ecosystem that operates on a decentralized network. Unlike CeFi, DeFi does not rely on centralized entities to provide financial services. Instead, DeFi protocols are built on blockchain technology and run through smart contracts. Some of the features of DeFi include:

Without permission

One of the defining characteristics of DeFi is its permissionless nature. This means that anyone can access the DeFi ecosystem without requiring approval from any authority or entity. In traditional finance, banks and other financial institutions act as gatekeepers, deciding who can access their services. CeFi users must go through a complex KYC process to access the services, which requires them to share personal information or make a deposit. In contrast, DeFi operates on a decentralized network that allows anyone with an internet connection to participate in the ecosystem.

Untrustworthy

Another key feature of DeFi is trustlessness. In traditional finance, trust is created through intermediaries such as banks or financial institutions. These intermediaries act as a trusted third party that verifies transactions and manages user funds. However, in DeFi, trust is created through blockchain technology. Transactions are verified and recorded on a public blockchain, eliminating the need for intermediaries. With the ability to control the underlying smart contract code, the DeFi space increases trust in banking services.

Rapid innovation

The DeFi ecosystem is characterized by rapid innovation. Due to its open and permissionless nature, developers can easily create and deploy new applications on the blockchain without needing approval from any central authority. This has led to the creation of a wide range of DeFi applications such as decentralized exchanges, lending platforms, insurance protocols and many more. These apps are constantly evolving to provide DeFi users with innovative and efficient financial services.

We have an article that explains in detail what DeFi is.

How is DeFi different from CeFi?

Both centralized and decentralized financial systems pursue the same goal. They want to increase trading volume and popularize cryptocurrency trading. However, the two ecosystems achieve their goals in different ways.

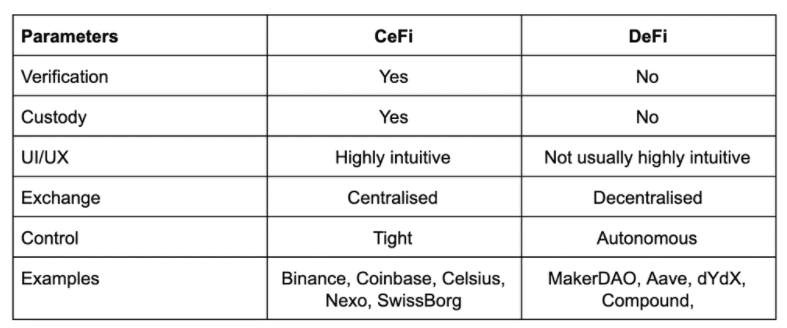

Care

Escrow is one of the key differences between DeFi and CeFi. Users' assets are held in custody by financial institutions like banks in CeFi, meaning they have to trust them with their money. DeFi services, on the other hand, allow consumers to keep their funds and give them complete control over their assets.

Crypto asset trading

Another major difference between DeFi and CeFi is the way they handle crypto asset trading. In CeFi, trades are usually done on centralized crypto exchanges owned by a single entity. In contrast, DeFi operates on decentralized exchanges (DEXs) that are open to all and require no intermediaries. With a decentralized exchange, traders can quickly register and trade their crypto assets directly with each other.

Transaction costs

Transaction costs are another area where DeFi and CeFi differ. In CeFi, transaction costs are usually high due to the presence of intermediaries, while in DeFi, transaction costs are usually lower. Conversely, using DeFi requires sending transactions to the blockchain, so merchants have to pay network fees.

Privacy

DeFi and CeFi differ when it comes to privacy. CeFi verifies the identity of users and tracks their transactions, making it difficult for them to maintain their privacy. Meanwhile, DeFi allows users to maintain their private identity when accessing the system.

Public verification

Public verification is another area where DeFi and CeFi differ. In CeFi, financial institutions are usually the only ones with access to the information needed to verify transactions. In contrast, DeFi operates on a public blockchain, meaning that transactions can be verified by anyone.

Atomicity

In blockchain technology, transactions can involve multiple financial actions that take place sequentially. These actions can be atomic, meaning that either all actions will complete successfully, or none. CeFi does not have this programmable atomicity feature. Instead, it uses costly and slow legal agreements to ensure atomicity.

DeFi has already brought some disruptive financial services to life. But the decentralized financial ecosystem does not end there: read this article to find out what DeFi 2.0 has to offer.

Similarities between Centralized and decentralized finance

Centralized finance and decentralized finance share some similarities such as the basic purpose of facilitating financial transactions. The aim of both systems is to enable users to access financial services and products. In addition, both models require a certain level of trust from users, whether it is a centralized authority or smart contracts in a decentralized system. Both systems also include digital currencies, albeit in different forms.

However, the differences between centralized and decentralized finance are significant, including the level of control, availability and security of financial transactions.

Ultimately, the choice between CeFi and DeFi depends on the user's preferences and needs.

Synergy between DeFi and CeFi

Synergies between DeFi and CeFi refer to the potential benefits and opportunities that can arise from the integration of decentralized finance (DeFi) and centralized finance (CeFi) systems. DeFi offers advantages such as open access, transparency and decentralized governance. CeFi, on the other hand, maintains infrastructure, compliance and liquidity. By combining the strengths of both, users can make the most of improved liquidity, availability and security. For example, CeFi can provide liquidity to the DeFi ecosystem, while DeFi can offer a more transparent and open financial system. Or, users can use CeFi to buy crypto assets and then move those assets to DeFi for higher returns. Similarly, through DeFi, users can access services unavailable on CeFi, such as peer-to-peer cryptocurrency lending.

What is CeDeFi?

CeDeFi is a financial system that combines the best features of CeFi and DeFi. CeFi is a traditional banking financing system, while DeFi is based on cryptocurrencies and smart contracts. CeDeFi offers the same features as DeFi protocols while being centralized, allowing people to access DeFi products such as decentralized exchanges, liquidity aggregators, revenue management tools, and lending protocols.

Unlike DeFi, CeDeFi projects lean more toward centralization, often controlled by a single or small group of entities, allowing for greater control. The CeDeFi ecosystem aims to improve the traditional cryptocurrency model, offering faster transactions, improved security, higher transaction volume and comparatively lower fees than traditional systems.

As the DeFi space continues to grow, more synergies are likely to emerge between the two financial systems.

Final words

In conclusion, DeFi and CeFi are two different financial systems operating on different principles. While DeFi is decentralized and offers users full control over their assets, CeFi is centralized and relies on intermediaries to facilitate transactions. However, there is great potential for synergy between the two systems, from which users can ultimately benefit.

CeFi vs DeFi: FAQs

What is the difference between CeFi and TradFi?

CeFi and TradFi are two different terms describing the types of financial systems on the market. CeFi refers to centralized finance while TradFi refers to traditional finance.

CeFi is a newer concept that emerged with the advent of cryptocurrency and blockchain technology. It refers to financial systems that are centralized and controlled by a single entity, such as a corporation or government. CeFi platforms are often built on blockchain technology, but are governed by a central authority that can decide how the platform operates.

TradFi refers to traditional financial systems that have been around for many years. These systems are usually centralized and controlled by multiple entities, including banks, governments and regulators. TradFi systems include traditional banking, insurance and investment products that have been around for decades.

In summary, the main difference between CeFi and TradFi is that CeFi is a newer blockchain-based financial system controlled by a single entity, while TradFi refers to traditional financial systems controlled by multiple entities. Besides, they have been around for many years.

Is Coinbase CeFi or DeFi?

Coinbase is a CeFi (Centralized Finance) platform, which means it is a centralized exchange that offers a platform for buying, selling and trading cryptocurrencies. Coinbase manages user assets and acts as an intermediary between buyers and sellers. Unlike DeFi (decentralized finance) platforms, which operate on a decentralized network and allow users to have full control over their assets without intermediaries, Coinbase is regulated and subject to traditional financial regulations.

Is CeFi better than DeFi?

Whether CeFi is better than DeFi depends on individual preferences and needs. CeFi has insurance protection of funds. However, it also typically has higher fees and less transparency. DeFi offers greater transparency, but also brings risks associated with smart contract technology. Ultimately, it comes down to an individual's priorities and risk tolerance to determine which one is better for them.

Disclaimer: Please note that the content of this article is not financial or investment advice. The information provided in this article is solely the opinion of the author and should not be considered a trading or investment recommendation. We make no guarantees as to the completeness, reliability or accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader or regular user of cryptocurrencies should research the various points of view and familiarize themselves with all local regulations before investing.