How to Calculate ROI in Crypto

Nobody likes math until math is about money.

It's a familiar scene: you've been saving for a while, maybe you've quit smoking or cut down on fast food, or you've even gone so far as not to blow your entire paycheck into the Steam Summer Sale. Either way, you now find yourself with some spare cash and a burning desire to invest.

Let's say you buy $10,000 worth of Bitcoins. And then what? You have two options. The first is to sit and do nothing. Maybe pray that Elon Musk doesn't tweet anything nervous (again) that will cause bitcoin to crash. Or, for the second option, you can calculate the ROI like a pro. Scary as it may sound, it's not beyond the capabilities of a person who knows how to push the buttons on a calculator and reads this neat little guide.

What is the return on investment (ROI)?

Investing in cryptocurrencies can bring high returns: according to coinmarketcap, Bitcoin brought its investors more than 29,000% ROI, and Ethereum – more than 107,000%. Why does this – cochamacallit – ROI exist and how does it work?

Return on investment, or ROI, is popular in various spheres, not just DeFi. business sharks and commercial dolphins, traders, budding entrepreneurs, real estate investors and HR managers – they all need a profit forecasting tool. And the ROI formula delivers.

The ROI metric is sometimes called the “quick and dirty method” because it's a simple formula that can be calculated on a napkin. However, it is a widely known financial metric that is usually used before any serious investment.

ROI is a formula that measures the performance of an investment and determines whether it is efficient and profitable. It can be used to value one or more different assets and compare them.

Do not confuse ROI with ROR, which stands for rate of return. Know the main difference: ROR can indicate a period of time, but ROI does not. Abbreviations like ROMI and ROAS also mean different calculations. A subtle but important thing to remember.

How to Calculate Return on Investment (ROI)

Unlike last season of Game of Thrones, the ROI calculations won't blow your expectations. They are always the same and quite simple. This investment property is calculated to avoid mistakes that would lead to wasted money. The calculation provides a clear idea of the level of efficiency of your assets and provides an opportunity to estimate the percentage of profit that you will get after investing your hard-earned funds.

ROI is a percent this is calculated by dividing the investment profit (or loss) of its initial costs or expense. Simply put, you take the number you got from the investment and subtract the investment cost from it. This is yours net income. Hang in there – we're almost done. So the number you get by subtracting is to be divided by the investment cost. Unsubtracted, divided. The number you get is the ROI. The higher it is, the more profitable the investment.

Okay, okay, keep breathing, stay with us.

Why is the ROI metric represented as a percentage when I get a number like 0.4 or 0.2? Well, you can't just keep calculating ROI with regular numbers and get a %. To get a percentage, multiply the number by 100: 0.4 × 100 = 40%.

Here is a video on how to calculate ROI

For those of you rare visual learners, we tracked down an ROI calculation video from the internet:

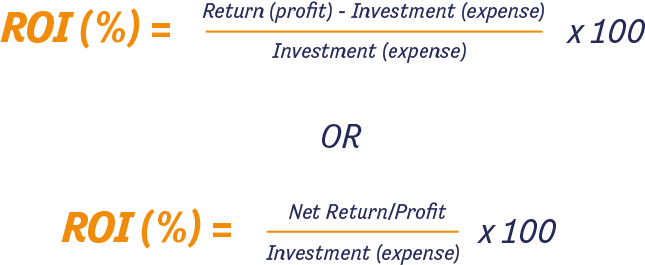

The ROI formula

Visually, the ROI formula is quite simple and looks like this:

ROI = (Gain of Investment – Cost of Investment) / Cost of investment

The first action is to calculate your net income (the profit from the real estate investment after expenses). If you already know your net income, just divide it by the investment costs. Be aware that in some formulas you find on the Internet, the investment cost is sometimes called the investment base, but it means the same thing. To get a percentage of a number, multiply it by 100.

Via magora-systems.com because we were too lazy to open Microsoft Paint

ROI example

ROI is the best way to find out the potential value of owning the cryptocurrencies you own. For example, if Elon Musk buys Solana at $120/SOL and the price goes up to $400/SOL, which is entirely possible given that Solana is now one of the primary currencies on OpenSea, what will the ROI be?

400 / 120 = 3.3 × 100 = 333.3% ROI

Just looking at the profit percentage makes us buy SOL immediately.

Alternative ROI calculation

There are different formulas for calculating ROI for a business venture, but they are essentially the same. It is either:

ROI = Money I Earned – Money I Spent / Total Cost of Investment

or

ROI = Investment Net Income (which is basically the same money I gained – money I spent) / Total investment costs

or

ROI = Return on Investment / Investment Base (spoiler: it's the same as above)

As you can see, the alternative method of calculating predicted ROI is an illusion.

How to calculate ROI for a startup

You invented a non-melting ice cream machine that cost $10,000,000. After selling ice cream for a while, you start to hate it: the taste, the texture, everything.

You wished you were selling pooping flamingos instead.

You give up a $30,000,000 machine. In this case, your net profit is +$20,000,000. 20M/10M = 2. That means your ROI is 200%. Good investment and good return on investment.

How to calculate ROI for a marketing campaign

You are the head of ClearlyNotYouTube. Someone posted a meme about you on Reddit, resulting in 69,000 conversions and $1,000 in profit. That's good because you only spent $2 on ads. Unfortunately, you will be on the hook for $69,001,000 in legal fees because the real YouTube sued you.

ROI = $998 – $69,001,000 = – $69 million. Divide –$69 million by 2 to get a basic ROI calculation. Your ROI doesn't look good. You end up with what is called a negative ROI.

What is Annual Return on Investment?

In short, it's the ROI you need if your investment opportunity is measured flight. Annualized ROI is the annual rate of return on an investment that takes into account how long the investment is held. It shows how your investment is performing over a period of time. The formula for annual return on investment is more complex:

Annualized ROI = ((1 + ROI) 1/n – 1) × 100%

N in the formula represents the number of years for the investment.

Comparison of investment and annual return on investment

Annual ROI is an elegant way to compare returns between different investments. For this you will need the following formula:

AROIₓ = annual return on investment for crypto X

AROIₙ = annual return on investment for crypto N

Then subtract the higher number from the lower number to see how profitable one initial cryptocurrency investment is compared to the other.

How to calculate ROI in Excel

As “not cool” as it sounds, ROI calculations in Microsoft Excel are faster than a calculator and much faster than a napkin. It also provides financial security.

Step 1. Open Excel.

Step 2. Wait for it to load.

Step 3 Wait something more until it recharges, maybe make some tea, read a couple of Shakespeare's sonnets – they're good for the soul.

Step 4. Excel finally loads, yay.

Step 5. With a blank workbook, create the following cells for ROI calculations:

- The date of the transaction

- Price at time of purchase

- The amount you paid for crypto USD, EUR, CAS, etc.

- Number of coins purchased

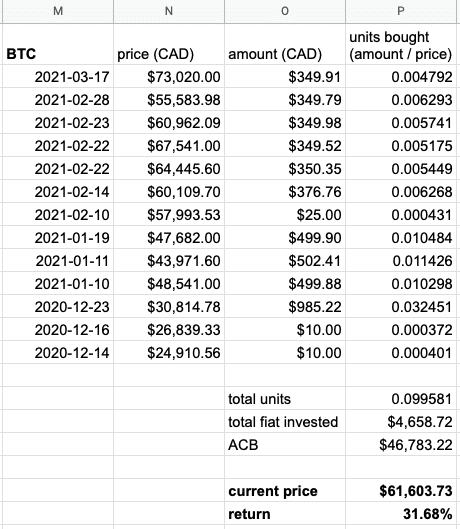

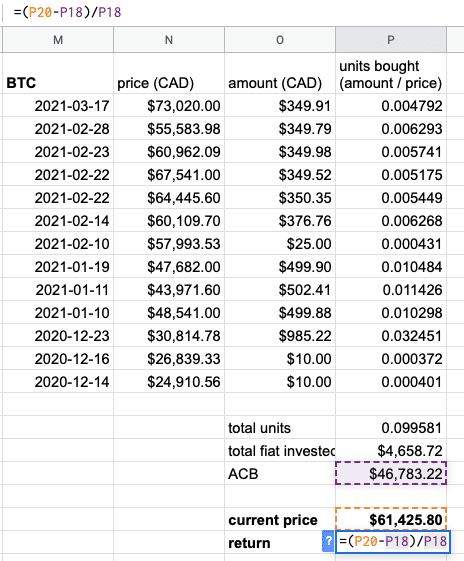

The template will look like this (examples by Steven Cheong on medium):

Enter the current price of the cryptocurrency as shown in the example. For Google Sheets, you can enter “=GOOGLEFINANCE (Your cryptographic name)” in the current price cell. To get ROI, use the following formula: return = (current price – average price) / total cost.

Voilà, this is how you calculate ROI in Excel without a third-party ROI calculator.

Disclaimer: Please note that the content of this article is not financial or investment advice. The information provided in this article is solely the opinion of the author and should not be considered a trading or investment recommendation. We make no guarantees as to the completeness, reliability or accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader or regular user of cryptocurrencies should research the various points of view and familiarize themselves with all local regulations before investing.