Bear vs Bull Market in the Crypto Industry: An Overview

The cryptocurrency market has been known for its high volatility and potential for massive returns, attracting investors worldwide. However, just like the traditional stock market, the cryptocurrencies also experience bull and bear markets. In this article, we’ll explore the characteristics of bull and bear markets in the crypto industry and discuss how to recognize them and when to invest in cryptocurrencies.

Bull Market Characteristics

A bull market occurs during a period of sustained growth in financial markets, characterized by rising asset prices and increased investor confidence. In the crypto industry, a bull market typically exhibits the following features:

- Rising prices. The prices of cryptocurrencies, including major coins like Bitcoin and Ethereum, increase over an extended period.

- Increased trading volume. Trading volumes surge as more investors enter the market, looking to capitalize on the rising prices.

- Strong market sentiment. Investor confidence is high, with many participants believing that the market will continue to rise.

- Positive news. Developments in the crypto industry, such as regulatory advancements or technological innovations, as well as a booming economy, contribute to positive market sentiment.

- Decreased unemployment rates. As the overall economy strengthens, unemployment rates may go down, leading to increased consumer spending and investment.

How to Recognize a Bull Market

Recognizing a bull market in the crypto industry involves identifying various signals, both trading signals and real-life indicators, that can hint at an upcoming bull market. Here are some tips to help you spot a bull market:

- Rising stock prices: Monitor the price movement of major cryptocurrencies, as well as the general stock market performance. If prices are consistently rising over a few weeks or months, it could indicate a bull market.

- Increased trading volume: Observe trading volumes of cryptocurrencies on major exchanges. A significant surge in trading activity can signal the beginning of a bull market.

- Positive news and events: Stay up to date with the latest developments in the crypto industry and broader financial market. Positive news and events can drive investor confidence and contribute to a bull market.

- Strong market sentiment: Use tools like the Crypto Fear & Greed Index to gauge the overall market sentiment. High levels of optimism can signify a bull market.

- Historical trends: Analyze historical market trends, as bull markets tend to occur in cycles. Consider the duration of the average bull market and compare it with the current market conditions to anticipate when the next bull market might occur.

Bear Market Characteristics

A bear market, in contrast to a stock or crypto bull market, refers to a period of decline in financial markets characterized by falling asset prices and waning investor confidence. In the crypto industry, a bear market typically exhibits the following features:

- Falling prices. The prices of cryptocurrencies, including major coins like Bitcoin and Ethereum, decrease over an extended period.

- Decreased trading volume. Trading volumes drop as investors exit the market, looking to minimize losses or wait for better opportunities.

- Negative sentiment in the market. Investor confidence is low, with many participants fearing that the market will continue to decline.

- Adverse news. Developments in the crypto industry, such as regulatory crackdowns or hacking incidents, contribute to the negative market sentiment.

- Increased unemployment rates. As the general economy weakens, unemployment rates may rise, leading to decreased consumer spending and investment.

How to Recognize a Bear Market

Recognizing a bear market in the crypto industry demands observing an array of signals, which include trading indicators and real-life signs, that may imply an upcoming bear market. Here are some distinct tips to assist you in spotting a bear market:

- Sustained decline in stock prices: A bear market usually involves a continuous period of negative returns in the stock market performance of major cryptocurrencies. If you notice a protracted downturn in the crypto market, it might be an indication of a bear market.

- Rising unemployment rates: An increase in unemployment rates can impact the broader financial market, leading to shrinking investment and spending in the crypto market. This can be a sign of an impending bear market.

- Heightened market volatility: A higher level of market volatility and sudden, sharp price drops in major cryptocurrencies might indicate that a bear market is on the horizon.

- Economic indicators: Pay attention to key economic indicators, such as inflation and interest rates, which can impact investor sentiment and lead to a bear market. Rising inflation and interest rates may contribute to a bear market in the crypto industry.

- Sector-specific issues: Problems or negative developments within the crypto industry, such as regulatory crackdowns or security breaches, can trigger a bear market. Keep an eye on industry-specific news to identify potential issues that might lead to a market downturn.

Comparing these factors with those mentioned in the “How to Recognize a Bull Market” section can offer a better understanding of the various signs and indicators associated with bear and bull markets in the crypto industry.

What Is a Bull/Bear Ratio?

The bear-bull ratio (also known as a bull-bear index or bull-bear spread) is a fascinating market sentiment indicator, especially in the context of the cryptocurrency market. It’s like a barometer that gauges the prevailing mood among investors — whether they’re feeling confident (bullish) or a bit wary (bearish) about the future of cryptocurrencies. Let’s delve deeper into how this works:

Bearish Investors

These individuals are the cautious ones in the crypto world. They might be analyzing trends that suggest a downturn is coming, or perhaps they’re just inherently more risk-averse. Their belief that the price of a cryptocurrency will fall influences their investment decisions, and they might either sell off their holdings or avoid buying more.

Bullish Investors

In contrast, bullish investors are the optimists of the market. They might see potential in new technological developments in blockchain, regulatory changes or simply believe in the long-term value of cryptocurrencies. Their belief in a price increase leads them to buy or hold onto their crypto assets, expecting future profits.

The Ratio Itself

Calculating the bear-bull ratio is pretty straightforward. It’s a matter of dividing the number of bearish investors by the number of bullish ones. For example, let’s say in a survey of 100 investors, 60 believe the market will go down (bears), and 40 believe it will go up (bulls). This would give us a ratio of 1.5 (60/40), indicating a heavier bearish sentiment.

Interpreting the Ratio

Here’s what the ratio tells us about:

- Greater than 1: A ratio above 1 signifies that bears outnumber bulls. It’s like having more people in the room expecting rain rather than sunshine, painting a somewhat gloomy picture of market expectations.

- Less than 1: If the ratio falls below 1, the bulls take the lead. This suggests an overall optimistic view among investors, with expectations of rising prices and potentially lucrative outcomes.

- Equal to 1: An even 1:1 ratio would mean a balanced view in the market, where equal numbers of investors expect both ups and downs.

Using the Ratio in Crypto Markets

In the ever-changing landscape of cryptocurrencies, the bear-bull ratio offers investors a quick way to capture the general sentiment. It’s particularly useful in a market known for its volatility, as crypto prices can swing wildly based on investor sentiment, news, and global events.

However, it’s important to remember that the bear-bull ratio is just one tool in an investor’s toolkit. Cryptocurrency markets can be influenced by a wide range of factors, including technological advancements, regulatory news, broader economic conditions, and more.

Bear versus Bull Market: When to Invest in Crypto

Deciding when to invest in the crypto market depends on various factors, including your investment goals, risk tolerance, and market conditions. Here are some guidelines to consider when deciding to invest in crypto during bull and bear markets:

Investing During a Bull Market

- Do your research. Thoroughly research the cryptocurrencies you’re considering investing in. Evaluate their fundamentals, market position, and growth potential.

- Diversify. Spread your investments across multiple cryptocurrencies to mitigate risk. Investing in a mix of established coins and promising projects can help maximize your potential returns.

- Monitor market conditions. Stay informed about market developments and be prepared to adjust your investment strategy if market conditions change.

- Consider dollar-cost averaging. Instead of trying to time the market, invest a fixed amount at regular intervals to average out the cost of your investments over time.

Investing During a Bear Market

- Focus on fundamentals. Look for cryptocurrencies with strong fundamentals, such as a solid development team, active community, and real-world use cases. These projects are more likely to withstand market downturns and recover when market conditions improve.

- Take a long-term perspective. Bear markets can be an excellent opportunity to buy cryptocurrencies at a lower price, but you need to be prepared to hold your investments for an extended period until the market recovers.

- Consider staking or lending. During a crypto bear market, consider staking or lending your cryptocurrencies to earn interest or passive income. This can help offset potential losses from price declines.

- Maintain a cash reserve. Keep a cash reserve to take advantage of any sudden market changes and potential buying opportunities.

Conclusion

Understanding the differences between bull and bear markets in the crypto industry is crucial for making informed investment decisions. By recognizing the characteristics of each market type and adjusting your investment strategy accordingly, you can potentially maximize your returns and minimize risks. Remember that investing in cryptocurrencies involves inherent risks, and it’s essential to consider your risk tolerance and investment goals before diving into the market. If possible, you can also try to contact financial advisors.

Whether you’re investing during a bull or bear market, staying informed about market trends, news, and developments is key to making sound investment decisions. As companies like Walmart and Reddit continue to explore and adopt blockchain technology, the crypto industry will likely continue to evolve and present new opportunities for investors. So, always be prepared to adapt your investment strategy to the ever-changing landscape of the crypto market.

FAQ

Are we in a bull or bear market in 2023?

2023 and the previous year experienced a decline in the crypto market, along with other financial markets. BTC reached its recent low of $16,500 in November 2022. Since then, it has grown to a level of $34,000 as of November 2023. Given this recovery, some experts might argue that the bull market began, reflecting a shift in investor sentiment and market trends.

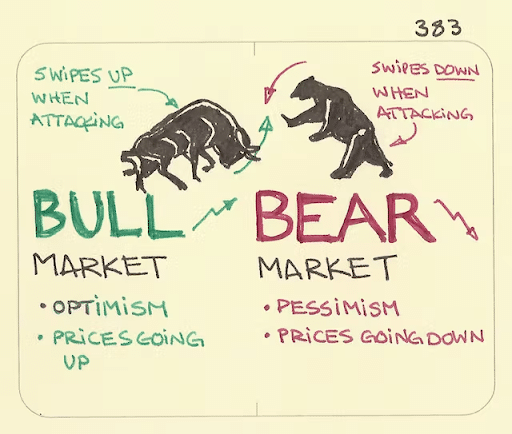

Why is it called a bull and bear market?

The term “bull market” comes from the way a bull attacks by thrusting its horns upward, symbolizing rising stock prices and growing investor confidence. “Bear market” derives from the bear’s downward swipe, representing falling market prices and declining economic sentiment. These animal metaphors effectively illustrate market movements, with the bull symbolizing growth and the bear indicating decline.

Which is better: a bull or a bear market?

Whether a bull or a bear market is better largely depends on individual perspectives and goals.

In a bull market, as reflected in key indices like the S&P 500 or Dow Jones Industrial Average (DJIA), the economy is usually strong, and investor confidence is high. Stock prices are rising, which is great for investors as their portfolios tend to increase in value. However, the downside is that it might lead to overvaluation of stocks, potentially inflating a bubble. For those not already invested, entering the market can be expensive.

On the other hand, a bear market, often associated with economic downturns, can lead to pessimism among investors. Stock values generally decline, which can hurt investment portfolios. However, bear markets can offer buying opportunities because stocks are cheaper. It also allows the market to correct overvaluations and can be a good time for new investors to enter the market.

For investors, bull markets are typically preferred for growth potential. However, savvy investors can also find opportunities in bear markets by purchasing undervalued stocks.

In terms of the overall economy, a healthy mix of both bull and bear markets is often seen as ideal. It prevents the economy from overheating and ensures periodic market corrections.

Ultimately, whether a bull or a bear market is better depends on your investment strategy, risk tolerance, and whether you’re looking for short-term gains or long-term growth.

What was the longest bear market in history?

The longest bear market occurred during the Great Depression, lasting from 1929 to 1942. This sustained period of time saw the broad market experiencing a significant decline in stock prices.

As for the shortest bear market, it occurred quite recently, at the beginning of the Covid-19 pandemic. It lasted just a bit more than 30 trading days.

What was the longest bull market in history?

The longest bull market in U.S. history began in March 2009, in the aftermath of a significant economic downturn and a severe collapse in the housing market. That bull market, characterized by steadily rising stock prices and investor confidence, continued for approximately 11 years, marking a period of remarkable economic recovery and growth. It eventually came to an end in February 2020, as the global economy faced the unprecedented challenges of the COVID-19 pandemic.

What is a bear market?

A bear market occurs when there is a prolonged decline in asset prices, typically by 20% or more from recent highs, across a broad market. This is usually accompanied by negative investor sentiment and deteriorating economic conditions. Bear markets tend to be associated with recessions, high unemployment rates, and other financial crises.

What is a bull market?

A bull market is a period of time during which asset prices consistently rise, generally driven by strong investor confidence, positive market sentiment, and strong economies. A bullish market often occurs in response to favorable economic conditions, technological advancements, or other favorable developments.

What’s the difference between investing during a bearish market vs. a bullish market?

Investing during a bearish market involves seeking out undervalued assets, anticipating that their prices will eventually rebound when the market recovers. It’s essential to maintain a diversified portfolio and focus on long-term growth during a bearish market. On the other hand, investing during a bullish market typically means capitalizing on the upward trend in asset prices, riding the wave of positive market sentiment, and taking advantage of the strong economic conditions. Regardless of whether a bear market bull transition takes place, it’s crucial to adapt your investment strategy according to the prevailing market conditions.

Is it good to buy in a bear market?

Yes, bear markets can provide good investment opportunities. When investors anticipate or recognize the onset of a bear market, it can be an opportune time to buy assets like cryptocurrencies, stocks, mutual funds, and ETFs at lower prices. This approach is based on the potential for these investments to increase in value when the market eventually recovers.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.