What are Dapps (Decentralized Applications) Crypto?

Recently, decentralized applications (dApps) have been increasingly used due to their potential to transform digital interactions.

In a conventional app ecosystem, control over user experience and data is typically managed by centralized entities such as app stores or platform providers. However, DApps offer users more performance because they are based on decentralized infrastructures that are not managed by any particular entity.

This article describes dApps, how they work, and their future potential. What do you think? Will decentralized applications be able to revolutionize various industries?

What are decentralized applications (dApps)?

By their definition, dApps are applications that run on decentralized networks, such as blockchains or peer-to-peer networks, without maintenance or control from a centralized authority. The popularity of dApps can be attributed to their ability to provide a transparent, secure and fair system compared to centralized applications. DApps differ from traditional applications in that they are not run by a single entity, giving users more control over their data and digital assets.

DApps are a promising and innovative technology with the potential to transform various industries and sectors, including finance, healthcare and logistics, among others.

What makes DApps different? DApps vs. traditional applications

There are several key differences between dApps and traditional applications.

Decentralized architecture

DApps are software applications that, due to their decentralized nature, do not rely on a centralized entity. Meanwhile, traditional apps are usually managed by a single entity, such as an app store or platform provider.

Transparency

Decentralized applications are based on a public ledger that makes all data and transactions transparent and difficult to change. Traditional apps, on the other hand, typically don't provide users with information about how their data is managed.

Safety

Applications running on a decentralized network have a security advantage as they are less vulnerable to cyber threats due to the absence of a single point of failure. In contrast, traditional applications are more prone to security issues.

Autonomy

Decentralized applications can operate independently, without intermediaries, which reduces transaction costs and speeds up the transaction process. Traditional applications often work with the help of intermediaries such as banks or other financial institutions, which can slow down the transaction process and increase costs.

Examples of DApps

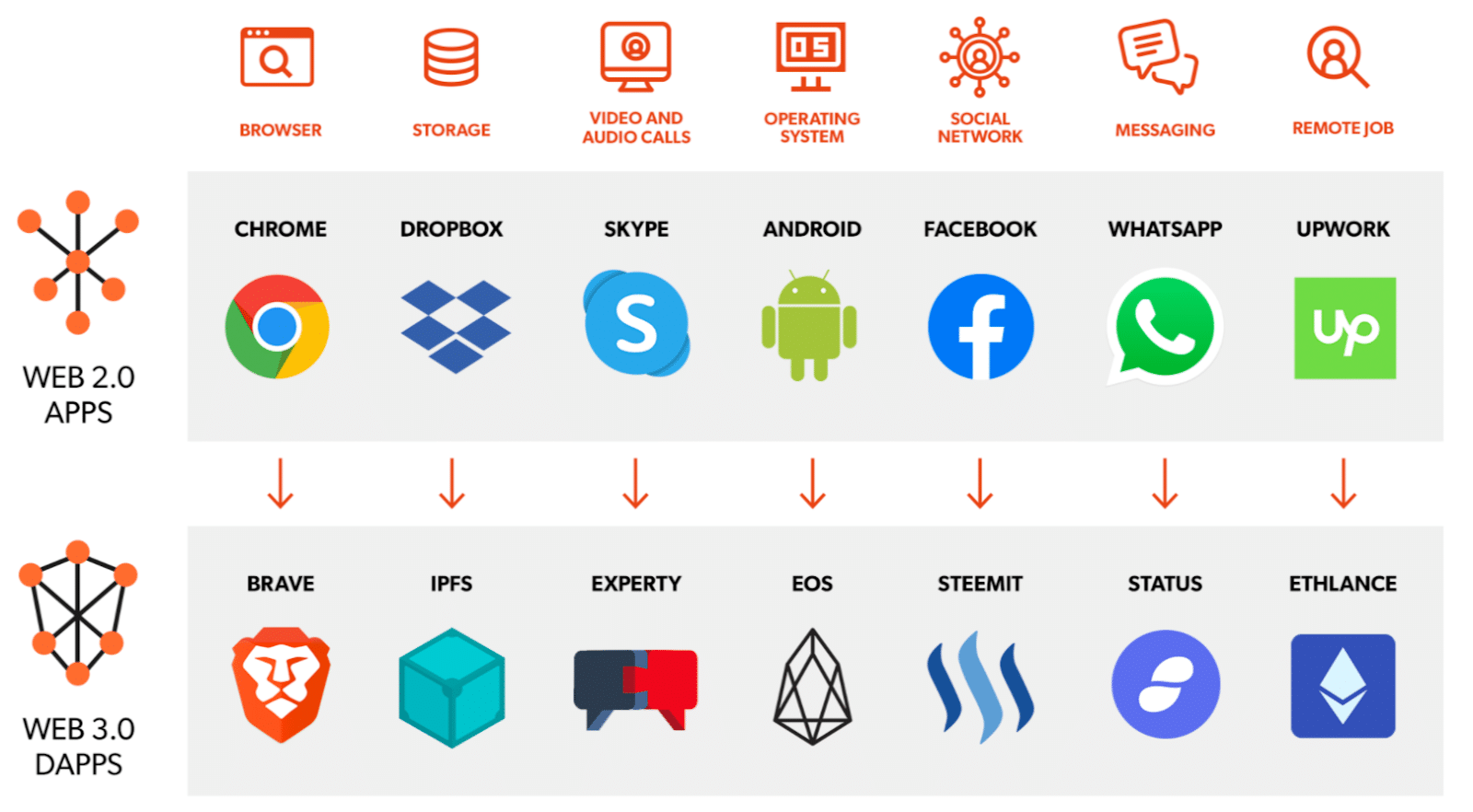

There are many different decentralized applications on different blockchain networks. The most popular platforms for dApps are the Ethereum network and Tron. According to DappRadar, most of the largest decentralized applications also fall into the DeFi (decentralized finance) category, with some gaming dApps and decentralized exchanges.

One such popular DEX is Uniswap, a decentralized exchange that allows users to trade cryptocurrencies without intermediaries. In addition, customers do not have to rely on a centralized server. Decentralization offers Uniswap users more control over their digital assets, as well as lower transaction fees and faster transaction times than centralized exchanges.

Another popular dApp is Brave Browser, a decentralized browser providing users with better privacy and security by blocking ads and trackers. Brave Browser allows users to manage their own online privacy and data through decentralization, as opposed to relying on centralized parties to protect personal data.

How do DApps work?

DApps are decentralized applications built on decentralized blockchain networks and run without central authorities. They rely on decentralized networks, smart contracts, tokens, user interfaces and consensus mechanisms to provide secure, transparent and efficient interactions with digital technology.

Decentralized network

DApps are applications that run on a network of distributed computers instead of a single server. This network is typically a blockchain, which is a decentralized database that stores data and transactions across a network of nodes.

Tokens

DApps often use tokens, which are digital representations of value such as cryptocurrency or virtual assets. Tokens can be held on the blockchain and transferred between users as a form of payment or ownership.

Consensus

In a network with a decentralized architecture, consensus ensures the validity and security of all transactions and data. Various consensus mechanisms such as Proof of Work and Proof of Stake can be used to achieve consensus.

Smart contracts

DApps typically involve smart contracts – digital agreements that are held on the blockchain and can be executed autonomously when predetermined conditions are met. Smart contracts enable dApps to operate autonomously and create a safer and more transparent digital experience for users.

Many dApps rely on smart contracts to automate certain functions and transactions. A decentralized exchange (DEX) dApp can use smart contract technology to facilitate trades between buyers and sellers without the involvement of a central governing body. A DeFi dApp can use a smart contract to allow borrowing and lending between users without the involvement of a central authority.

Challenges and limitations of DApps

While dApps offer many benefits such as transparency, security and autonomy, they also face several challenges and limitations.

- Scalability. Scalability is a big challenge for dApps. As the use of dApps increases, the network can become slower and congested. This can result in slower transaction times and higher fees, which can make it difficult for dApps to scale and support adoption.

- User experience. One of the challenges dApps face is ease of use. DApps are usually based on decentralized networks. This often goes hand in hand with complex user interfaces that require specific technical knowledge from users. As a result, dApps can be challenging for common users to adopt and use.

- Interoperability. Interoperability can be an issue with dApps running on different blockchains or using different standards. This can limit their functionality and usefulness.

- Ordinance. The adoption and development of dApps can be difficult due to regulatory uncertainty. Regulators can be uncertain about how to categorize dApps, what taxes they may be subject to, and what extent of regulation should be enforced.

The future of DApps

So far, the cryptocurrency is cautiously optimistic about the future of dApps. Decentralized applications have great potential to be the driving force behind cryptocurrency's journey into the mainstream. Of course, there are still a few challenges to overcome, such as the ones we listed above. However, the future of dApps still looks pretty bright.

There is a lot of research on the scene. As this is a new segment with high profit margins, it naturally attracts many entrepreneurs and talented professionals, which bodes well for all the above challenges to be solved eventually.

Research and development is conducted to improve the scalability and user experience of dApps. Implementing these improvements will make dApps easier to use and easier to access for regular users.

The potential applications for dApps are many and expanding. Each decentralized application provides an alternative way to interact with digital technology that is decentralized, transparent and secure across a range of industries, including finance, gaming and supply chain management. As more use cases are developed and proven, more users will be attracted to dApps.

Decentralized finance

DApps and decentralized finance are incredibly intertwined. As DeFi grows in popularity, so do use cases for decentralized applications, such as a decentralized credit service or exchange platform.

DeFi provides a new approach to interacting with financial services. The demand for decentralized financial systems is increasing as traditional financial systems and centralized applications receive more scrutiny and criticism due to the desire for greater autonomy and transparency.

FAQ

What are dApps for?

A decentralized application can be used for anything that can benefit from the transparency and security it provides. Currently, dApps are mainly used in DeFi, where they allow users to make financial transactions without intermediaries.

How are dApps different from regular apps?

Unlike applications running on centralized servers, dApps use decentralized networks such as the Ethereum blockchain. This allows them to cut out middlemen and provide a more trusted and secure way to process user data and transactions.

What can you use to interact with dApps?

This depends on the type of dApp you are using. Web browsers, games, exchanges, and so on can usually be accessed like any traditional application. However, some dApps are not that easy to use. In any case, you will most likely need to have a crypto wallet that can be connected to these platforms, such as MetaMask.

How can you create a dApp?

Creating a dApp is not an easy process. First, you'll need to choose a platform – Ethereum, EOS, and Tron are the most popular. Next, define your use case and think about what kind of problem your app will solve.

After that, it's time to start designing and developing your dApp. Make sure your interface is user-friendly and be careful when writing smart contracts to control your project's behavior. When you're done, don't forget to run extensive tests before deploying your new dApp.

Disclaimer: Please note that the content of this article is not financial or investment advice. The information provided in this article is solely the opinion of the author and should not be considered a trading or investment recommendation. We make no guarantees as to the completeness, reliability or accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader or regular user of cryptocurrencies should research the various points of view and familiarize themselves with all local regulations before investing.