Which One Is Right for You?

Welcome to the intriguing realm of investing, where opportunities abound for the insightful investor. Two significant investment vehicles often take center stage in this landscape: mutual funds and exchange-traded funds (ETFs). These tools offer the key to diversification, enabling investors to access a broad range of securities within a single fund. Yet, while they share common advantages, each carries its unique attributes, benefits, and potential drawbacks.

In this comprehensive article, we aim to unravel the complexities of these two prevalent investment vehicles. We’ll examine their defining characteristics, pinpoint their differences and similarities, and investigate which might best suit various types of investors.

I’m Zifa, your guide in this exploration. Together, we’ll delve deep into these two pivotal investment tools, demystifying their intricacies and determining how they can best serve your investment strategy. So let’s begin this informative journey.

Diversification is a cornerstone of a successful investment strategy. Are you ready to expand your portfolio with a promising asset? Consider seizing the opportunity to purchase a cryptocurrency. By doing so, you’re stepping into the future of finance. Changelly offers an effortless way to purchase Bitcoin, Ethereum, and over 450 other crypto assets. Join the crypto revolution and diversify your portfolio with Changelly today!

What Is a Mutual Fund?

In simple terms, a mutual fund is a type of investment vehicle that operates by pooling together money from numerous investors. This money is then used to purchase a wide variety of securities, including stocks, bonds, and other assets. Such a mechanism enables individual investors to participate in diversified investments that they might not have been able to afford or manage on their own. Furthermore, mutual funds are managed by professional fund managers whose job is to allocate the fund’s assets with an aim to generate income or capital gains for the fund’s investors. Every share of a mutual fund represents an investor’s part of the ownership there and the income it generates.

2 Kinds of Mutual Funds

Diving deeper, we can categorize mutual funds into two main types — namely, open-ended funds and closed-end funds.

Open-Ended Funds

The open-ended fund is a more common type of mutual fund. Here, shares are issued and redeemed based on demand at the net asset value (NAV) of the fund. To put it simply, as more investors invest their money in the fund, new shares are created. Conversely, as investors redeem, shares are eliminated. The price of an open-ended fund share is determined by the fund’s NAV at the end of the trading day.

Closed-End Funds

Conversely, closed-end funds operate slightly differently. These funds issue a fixed number of shares during an initial public offering (IPO). These shares are then traded on an exchange, much like individual stocks. The price of these shares is determined by market demand, meaning it can deviate from the NAV, leading to shares trading at a premium or a discount to their actual underlying value.

What Is an ETF?

Just like mutual funds, an exchange-traded fund (ETF) is a type of investment fund that owns assets such as stocks, bonds, commodities, and more. ETFs also allow investors to pool their money into a fund that makes investments in a particular category of assets and get an interest in that investment pool. However — and here, the difference comes into play — ETFs are traded on stock exchanges, much like individual stocks.

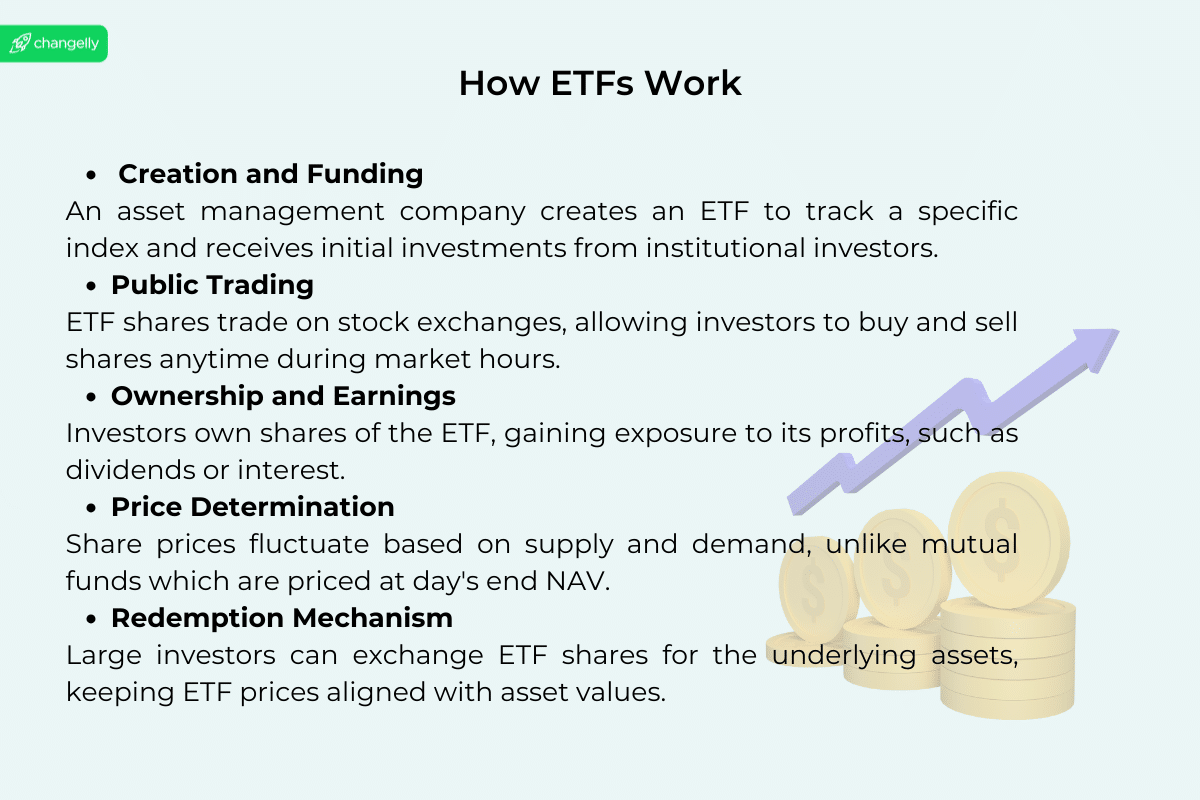

ETF Creation and Redemption

ETFs have a unique creation and redemption process that involves large institutional investors called authorized participants (APs). These APs can create new ETF shares by providing the ETF with the appropriate basket of underlying assets, or they can redeem ETF shares for the underlying assets. This unique mechanism helps to ensure that the ETF price stays close to its NAV.

ETF Benefits

ETFs offer several benefits, including the ability to trade shares throughout the day, similar to stocks, which contrasts with mutual funds that can only be bought and sold at the end of the trading day. They also typically have lower expense ratios compared to mutual funds and are more tax-efficient because of how shares are created and redeemed. Additionally, ETFs tend to be more transparent than mutual funds because they disclose their holdings on a daily basis.

Bitcoin ETFs have certainly been creating a buzz in the investment world. Stay ahead of the curve and explore our curated list of the top 5 Bitcoin ETFs.

3 Structures of ETFs

Broadly speaking, there are three main types of ETFs: open-end index ETFs, unit investment trust (UIT) ETFs, and grantor trust ETFs. Open-end index ETFs, which are the most common type, operate similarly to open-ended mutual funds. They can issue and redeem shares on an ongoing basis. UIT ETFs, on the other hand, are required to replicate the performance of specific indexes, which limits their investment options. Lastly, grantor trust ETFs allow investors to own the underlying shares of the companies in which the ETF is invested, thereby offering investors more direct ownership.

Differences between Mutual Funds and ETFs

| Feature | ETFs | Mutual Funds |

|---|---|---|

| Trading | Trade like stocks throughout the day with fluctuating prices. | Trade once a day at the day’s end NAV. |

| Management Style | Typically passively managed, tracking an index. | Can be actively or passively managed. |

| Fees | Often have lower expense ratios and no sales charges. | May have higher fees and potentially sales charges. |

| Investment Minimums | Can be bought with the cost of one share, no minimums. | Often have minimum investment requirements. |

| Tax Efficiency | More tax-efficient due to in-kind creation and redemption processes. | Might distribute taxable capital gains, less tax-efficient. |

| Dividend Reinvestment | Depends on the broker’s policies for reinvestment. | Easily allows for dividend reinvestment. |

| Liquidity | Offer intra-day liquidity, can be bought and sold during market hours. | Transactions execute after the market closes, no intra-day trading. |

Here’s a detailed list of their differences in a friendly and professional tone:

1. Trading and Pricing

- Mutual Funds are bought and sold at the end of the trading day at a price called the NAV (Net Asset Value), which is determined after the market closes. This means you won’t know the exact purchase or sale price at the time of your order.

- ETFs are traded on stock exchanges throughout the day at fluctuating market prices, similar to individual stocks. This allows for more flexibility and the ability to execute trades at known prices during market hours.

2. Investment Minimums

- Mutual Funds often have minimum investment requirements that can range from a few hundred to several thousand dollars, making it potentially more challenging for small investors to enter.

- Since ETFs are traded like stocks, you can buy just one share, with the minimum investment being the price of one share plus any commission fees (though many platforms now offer commission-free trading). So, investors with limited capital may find this option more accessible.

3. Management Style

- Mutual Funds can be actively or passively managed. Actively managed mutual funds have managers making decisions about how to allocate assets in an attempt to outperform the market, which can lead to higher fees. Passively managed mutual funds, like index funds, aim to replicate the performance of a specific index.

- ETFs are typically passively managed, focusing on tracking the performance of an index, which generally leads to lower expense ratios. However, there are actively managed ETFs as well, though they are less common.

4. Fees and Expenses

- Mutual Funds tend to have higher expense ratios due to the cost of active management in many cases. They may also charge sales loads (commission) and other fees.

- ETFs generally have lower expense ratios, especially for passively managed ETFs. They may incur brokerage commissions when bought and sold, but many brokers offer a range of ETFs that can be traded without commissions.

5. Tax Efficiency

- Mutual Funds can be less tax-efficient because the buying and selling of securities to meet redemption requests by shareholders can trigger capital gains distributions that are taxable to all shareholders.

- ETFs are generally more tax-efficient due to their unique creation and redemption process involving in-kind transfers, which typically do not trigger a taxable event. This makes ETFs particularly attractive for taxable investment accounts.

6. Dividends

- In mutual funds, dividends can be automatically reinvested, which allows investors to compound their returns without any transaction fees.

- ETFs also offer dividend reinvestment, but the process might be slightly different depending on the broker, and sometimes it can be less straightforward than with mutual funds.

7. Transparency

- Mutual Funds disclose their holdings quarterly or semi-annually with a lag.

- ETFs generally offer greater transparency, disclosing their holdings daily, which can be advantageous for investors who wish to know exactly what they own at any given time.

What Do ETFs & Mutual Funds Have in Common?

Despite these differences, ETFs and mutual funds do share a common ground. Both are types of investment funds, and as such, they provide a way for investors to hold a diversified portfolio of assets. This allows investors to spread their risk across many different securities. Both types of funds are managed by professional money managers, and they both aim to generate returns for their investors, either through income (like dividends or interest payments), capital gains, or a combination of both.

ETFs vs. Mutual Funds: Which Is Best for You?

The decision to invest in ETFs or mutual funds often comes down to the individual investor’s needs, goals, and investment strategy. If you value the ability to trade throughout the day, desire lower costs, and prioritize tax efficiency, ETFs may be a better choice. However, if you prefer a more hands-off approach, appreciate systematic investment options, and lean towards active management, then mutual funds might be more fitting.

Is It Better to Invest in the Market Through a Mutual Fund or ETF?

The answer to this complex question depends heavily on individual circumstances and investment goals. ETFs and mutual funds can be excellent vehicles for investing in the market. For passive investors with a long-term investment horizon, both of these can serve as robust tools to achieve diversification. ETFs might have an edge due to their generally lower expense ratios and greater tax efficiency, making them potentially more cost-effective over the long run. On the other hand, mutual funds can be more convenient for regular, automated investments due to features like dollar-cost averaging and the ability to purchase fractional shares.

What Are Actively Managed Funds?

Actively managed funds are portfolios overseen by a manager or a team of professionals who make ongoing, specific investment decisions based on research, forecasts, and their judgment. The objective of these funds, which could be either mutual funds or ETFs, is to outperform a specific benchmark index. Their management style tends to involve more frequent trading, leading to higher costs and potentially more significant tax implications for the investors.

What Are Passively Managed Funds?

Passively managed funds, conversely, seek to replicate the performance of a specific index. By investing in the same assets in the same proportions as the index, these funds aim to mirror the market’s performance rather than trying to beat it. This passive approach is less costly due to the lower turnover and simpler management process, making such funds more tax-efficient.

How do They Relate to ETFs and Mutual Funds?

Both active and passive management styles can be applied to mutual funds and ETFs. The difference lies in their structure and trading mechanisms, not their management style. ETFs are traded on an exchange like stocks, allowing buying and selling throughout the day. In contrast, mutual funds are transacted directly with the fund company at the daily net asset value (NAV).

What to Choose?

Choosing between active and passive funds — and ETFs or mutual funds per se — depends on individual investment goals, risk tolerance, time horizon, and personal preferences.

ETFs offer advantages in terms of lower fees, tax efficiency, and trading flexibility. That’s why cost-conscious investors and those seeking to exploit market timing may find them attractive.

Mutual funds, on the other hand, provide benefits for those seeking active management potential and ease of systematic investing. They appeal to investors who are less concerned with immediate liquidity or trading costs. By carefully considering these factors, investors can make a more informed choice that best suits their long-term investment goals and strategies.

Tax Considerations

- ETFs are known for their tax efficiency, largely due to the in-kind creation and redemption mechanism, which usually doesn’t trigger capital gains taxes. This feature is particularly advantageous to investors in taxable accounts.

- Mutual funds may incur taxable events when securities within the fund are sold by the manager, potentially leading to capital gains distributions to all shareholders, regardless of individual buy or sell actions.

Believers in the capacity of professionals to outperform the market, who are willing to pay higher fees for their expertise, may prefer actively managed funds. The choice between mutual funds and ETFs then comes down to whether you value the ability to invest regularly (as is easier with mutual funds) or the flexibility of intraday trading (offered by ETFs).

Alternatively, if you adhere to the efficient market hypothesis — the theory suggesting it’s nearly impossible to consistently outperform the market — you might lean towards passively managed funds. These typically lower-cost funds can offer you market-matching returns with better tax efficiency, especially in the case of ETFs.

However, there’s no universally right choice. What’s best for one investor might not be suitable for another. Thorough research or consultation with a financial advisor is always recommended before making investment decisions.

FAQ

Is S&P 500 a mutual fund or an ETF?

The S&P 500 is neither a mutual fund nor an ETF. It is an index that tracks the performance of 500 large companies listed on U.S. stock exchanges. However, numerous mutual funds and ETFs are designed to replicate the performance of the S&P 500. These funds hold the same securities in the same proportions as the S&P 500, allowing investors to broadly mimic the performance of the largest segment of the U.S. equities market.

Are ETFs riskier than mutual funds?

The risk of ETFs and mutual funds is largely determined by their underlying assets — that is, what the ETF or mutual fund invests in. ETFs, due to their structure and ability to be traded like stocks, could lead to more frequent trading and potentially increased costs, particularly if investors try to time the market or trade frequently. However, in general, an ETF that invests in a broad, diversified group of stocks is not inherently riskier than a mutual fund with similar investments.

Do ETFs pay dividends?

Yes, many ETFs do pay dividends to their investors. If an ETF includes dividend-paying stocks among its holdings, the dividends are collected and typically distributed to ETF shareholders. The frequency of these dividend payments can vary, but they often occur on a quarterly basis.

Which is safer: an ETF or a mutual fund?

The safety of an investment isn’t determined solely by whether it’s an ETF or a mutual fund. Rather, it depends on what the fund invests in, how well-diversified it is, the skills of the fund manager, and the overall market conditions. In general, funds (ETFs or mutual funds) that invest in riskier securities, such as small-cap stocks or junk bonds, will be riskier than funds that invest in safer securities, such as large-cap stocks or government bonds.

Should I invest in both an ETF and a mutual fund?

Investing in both ETFs and mutual funds can offer diversification benefits and balance your portfolio out. This approach allows investors to take advantage of the unique features of both types of funds. However, it should be based on individual financial goals, risk tolerance, investment strategy, and preferences.

Have index funds become more popular in recent years?

Yes, index funds, which include both index mutual funds and ETFs, have been growing in popularity due to their low costs and simplicity. They aim to mimic the performance of a specific index rather than outperform it. As many active fund managers have struggled to consistently outperform the market, an increasing number of investors have turned to index funds. This trend has been further bolstered by the rise of robo-advisors and the increasing awareness about the impact of high fees on long-term investment returns.

Mutual Fund vs ETF: Final Thoughts

In conclusion, while both mutual funds and ETFs can serve as effective investment vehicles, the decision between the two should be based on individual investment goals, risk tolerance, and personal preferences. By understanding the unique characteristics and benefits of each, investors can make informed decisions and choose the path that best aligns with their financial goals.

References

- https://www.bitpanda.com/academy/en/lessons/what-is-an-exchange-traded-fund-etf/

- https://www.nerdwallet.com/article/investing/how-to-invest-in-mutual-funds

- https://www.cnbc.com/select/what-are-mutual-funds/

- https://www.fidelity.com/learning-center/investment-products/etf/what-are-etfs

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.